The beauty of using QBO is automation but as we know technology is only as good as the person using it. If you DIY your bookkeeping, you may find data entry (and the reconciliation of those entries) a bit frustrating. Read on for a few tips and tricks to make life a little easier.

Connect your bank and credit card accounts to QBO

Connect your bank and credit card accounts so transactions will automatically sync with QBO. This will eliminate manual data entry.

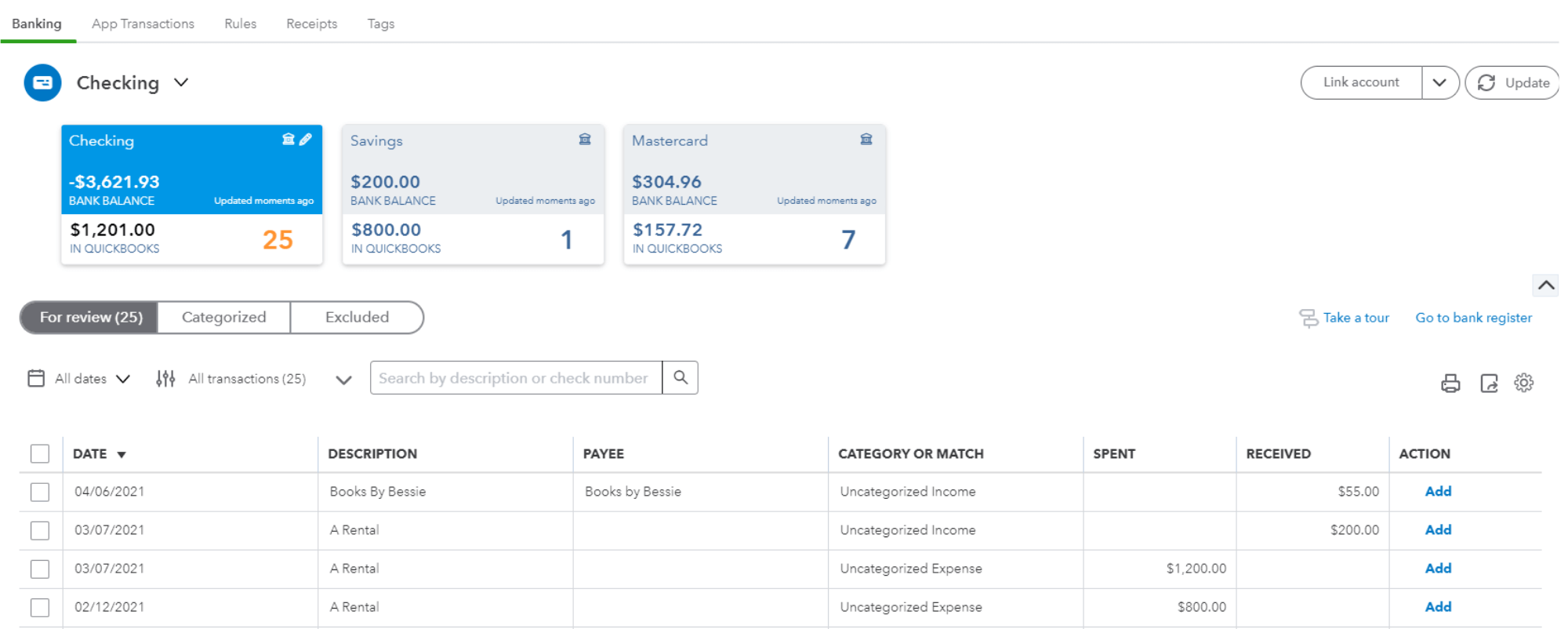

Once you have transactions sitting in your bank feed you will need to review, categorize and add/accept them so they will be added to your register. Here is where you needed to really take your time.

Each transaction that syncs from your bank and credit card account to QBO will have a date, description, category (suggested by QBO or based on a rule you establish), and amount.

The columns you want to pay attention to most are the payee and category.

Add a payee for each expense transaction

I am a stickler for adding a vendor payee, even if the payee shows in the description column. Why? Because there are many useful reports in QBO that are based on vendors. If you do not have a vendor name, the reports become inaccurate and therefore useless.

Categorize Consistently by using the rules feature

The category defines the type of income or expense you are entering. You can add a deposit or expense to an existing account or you can set up a new account that makes the most sense to you and your business. Consistency is the key when categorizing transactions. That’s where rules can be helpful. If you have recurring income or expense transactions, you can set up rules that will memorize the payee and category. You can set conditions for transactions that include details such as bank text, descriptions, and amounts. Simply click on the rule to open the transaction detail and choose ‘Create Rule’.

Turn of auto-add

When you create a rule, make sure Auto-add is turned off. I know I know, why would you turn that off it will do the work for you…Even with rules, I suggest reviewing what is in the bank feed before adding it to the register. There are times when an Amazon charge might not be office supplies. You want to be in full control of how your income and expense transactions are itemized.

Do not enter transactions as transfers

I may be in the minority here but I do not add transactions as transfers. A transfer is simply showing that money moved from one business account to another. The problem with adding a transaction as a transfer is that if it is reconciled in one account but incorrectly categorized, it can be harder to fix. As helpful as QBO tries to be, it is notorious for “recognizing” transfers incorrectly, another reason you should carefully review transactions before moving them from the bank feed to the register. So what should you do? Click on the transaction, choose ‘Categorize’ and for the category, choose the account to which the money moved.

Putting these tips in place will make reconciling each month much easier and ensure better accuracy of your financial reports. Still having trouble? I’d be happy to set up a training session with you.